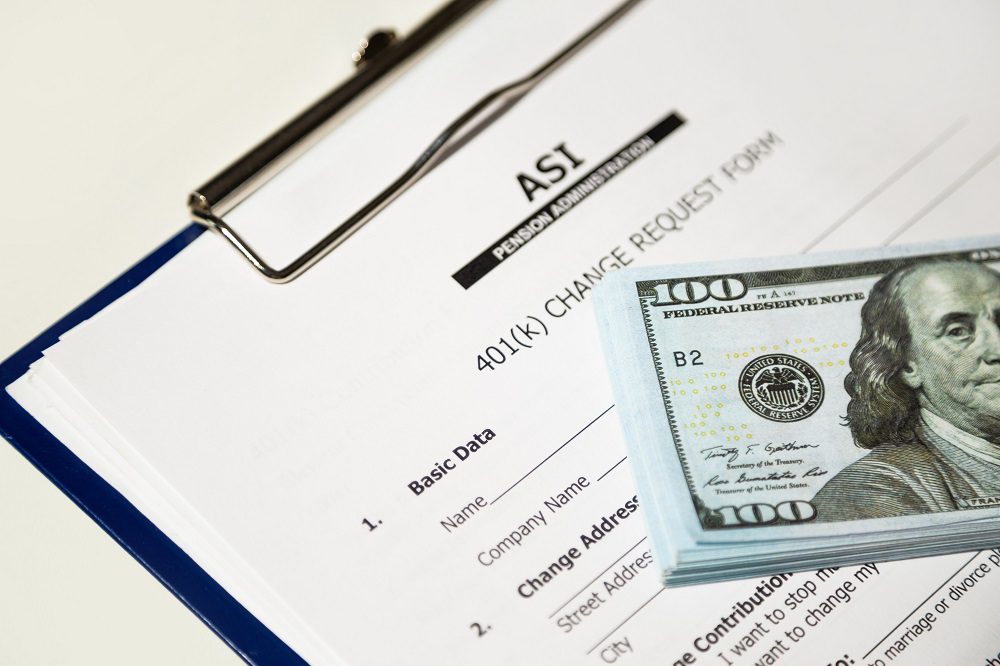

#3 Traditional IRAs and 401(k)s

Traditional IRAs and 401(k)s are popular among those of us who prefer to save every penny possible. Every contribution to the account is going to reduce the taxable income for that year, which turns into saving money on the tax bill. And when you are trying to save as much money as possible for retirement, this comes in handy. Not only that, but any investment gains, savings, and dividends inside these accounts will also be growing with deferred taxes.

However, there are a lot of things that people forget about these accounts, like the fact that they will end up having to pay taxes down the line! After you have reached retirement age and you start to make withdrawals, both the gains and the initial amount are going to be treated as taxable income. You can delay withdrawing the money, but in the end, you will have to make them.

Withdrawals from an IRA or 401(k) will be taxed at the ordinary income tax rate, with the exception that nondeductible and after-tax contributions will not be taxed.

Another thing to mention is to make sure that even if you have already started your retirement life, you should wait until you are over the age of 59 and a half before making withdrawals because otherwise you will be hit with a 10% penalty on top of the taxes!